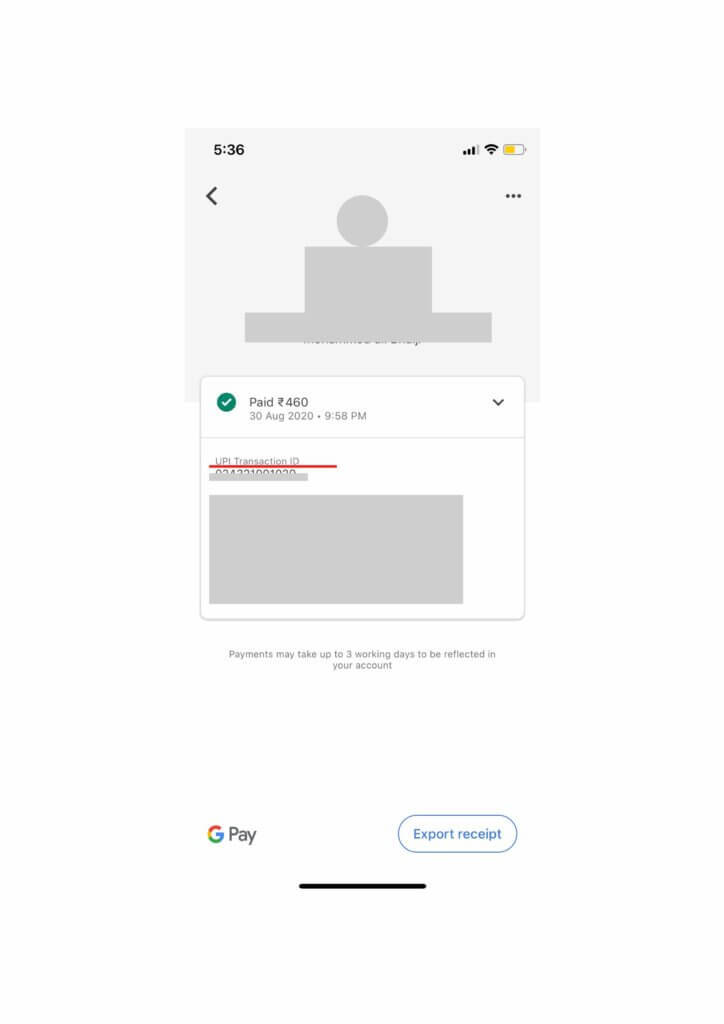

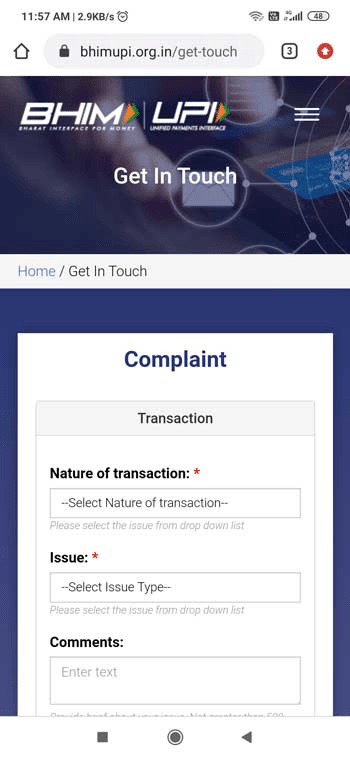

The contents of this article/infographic/picture/video are meant solely for information purposes. Every customer must understand what a UTR number is and how it works. Knowing the UTR number is integral to tracking the status of your transactions. You will find the transaction status here.Use the UTR number to look for a specific transaction.Check out the previous section on transfers.Go to your bank's mobile app or online banking account.Other ways to check on the progress of your transaction include: If your money is debited, but the recipient has not yet received the funds, you can contact the bank's customer service and request the transaction be tracked using the UTR number.Īnother alternative is to contact your allocated Relationship Manager and request that they use the UTR number to monitor the transaction. If your NEFT transaction is delayed, you can use the UTR number to check the transaction's progress. However, RTGS can only be used for amounts below ₹2,00,000. As a result, RTGS is the quickest way to transfer money from one bank to another. Within two hours of transferring funds using RTGS, the funds go into the recipient's account. Meanwhile, when you send money via RTGS, the bank transfers your funds quickly. NEFT takes place in half-hourly batches on weekdays and working Saturdays from 8 AM to 7 PM. Instead, they are executed in batches, meaning that the fund transfer does not happen immediately. NEFT transactions do not take place immediately. You can see the UTR number beside the transaction date, and it consists of 22 or 16 characters. You can download or view the account statement using your bank's mobile app, like IDFC FIRST Bank's banking app or internet banking. Your account statement is one of the easiest and most convenient ways to obtain the UTR number. In India, UTR numbers frequently look like this:Įach UTR number has a few characters that change depending on the bank that issues it. Below each transaction's information, you can see the UTR number as Ref no. You can find the UTR number on your bank statement. The number is generated by the banks conducting the transfer, and it helps quickly check the progress of your transactions. All Indian banks use UTR numbers for all forms of money transfers. In India, a UTR number helps verify a particular bank transaction. UTR stands for Unique Transaction Reference. Read on as we delve deeper into what it means.

A UTR number comes in handy in such a situation, allowing you to track the status of your transaction. However, even though both forms of money transfer are helpful, your transactions might get stuck sometimes. Services like NEFT and RTGS allow you to send funds overseas efficiently and quickly.

You can send money to India in a few different ways. Banks conducting the transaction issue it to help them track the status of the transaction. UTR is a number unique to every fund transfer.

0 kommentar(er)

0 kommentar(er)